In this third research area, I am interested in the comparative analysis of capital markets. Global finance has undergone significant changes since the global financial crisis 2007-2009 with the rise of China and other emerging markets which significantly impact the dynamics of financial globalisation and its impact on the global norms, institutions and governance that underpin the global economy.

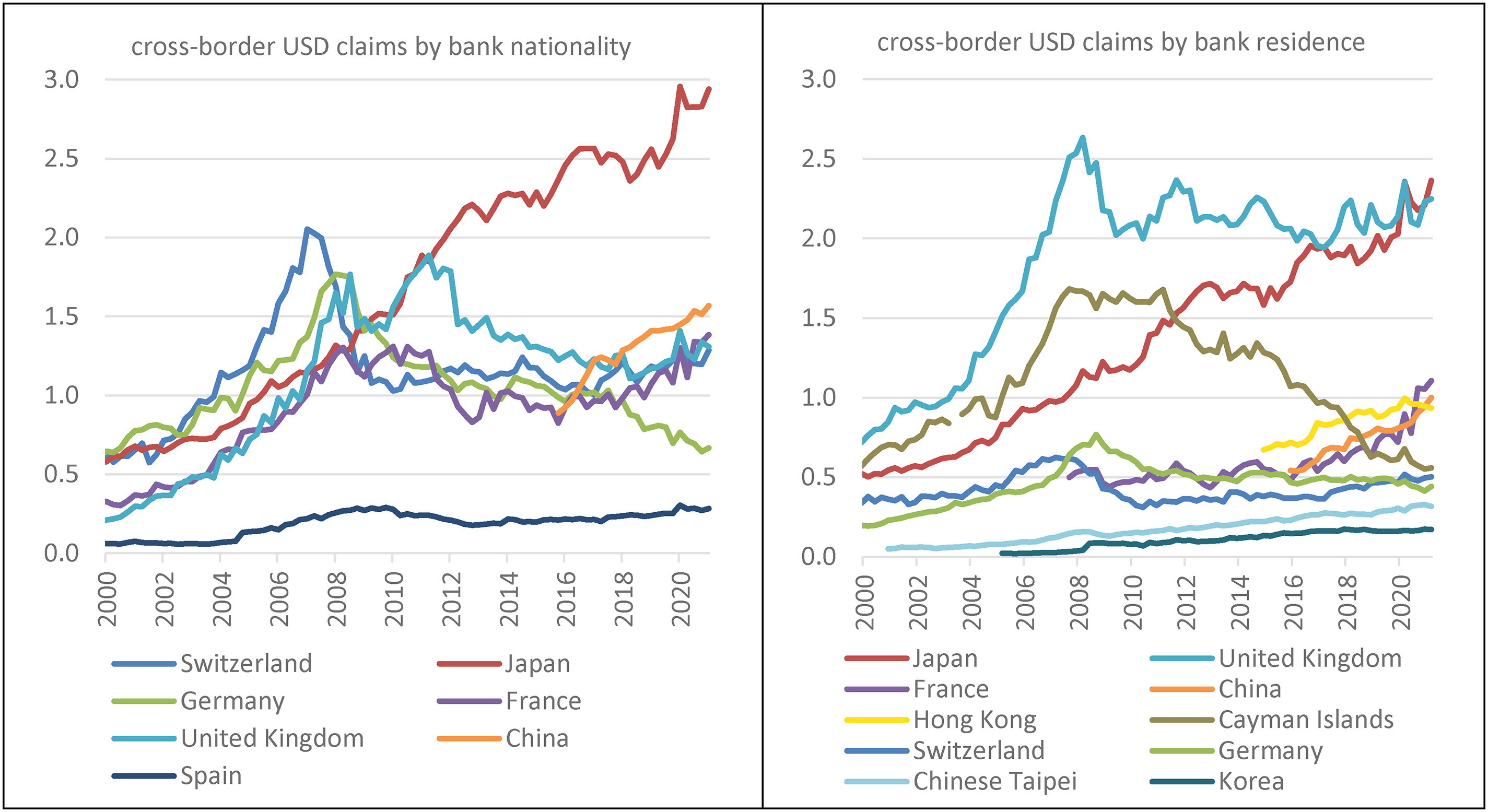

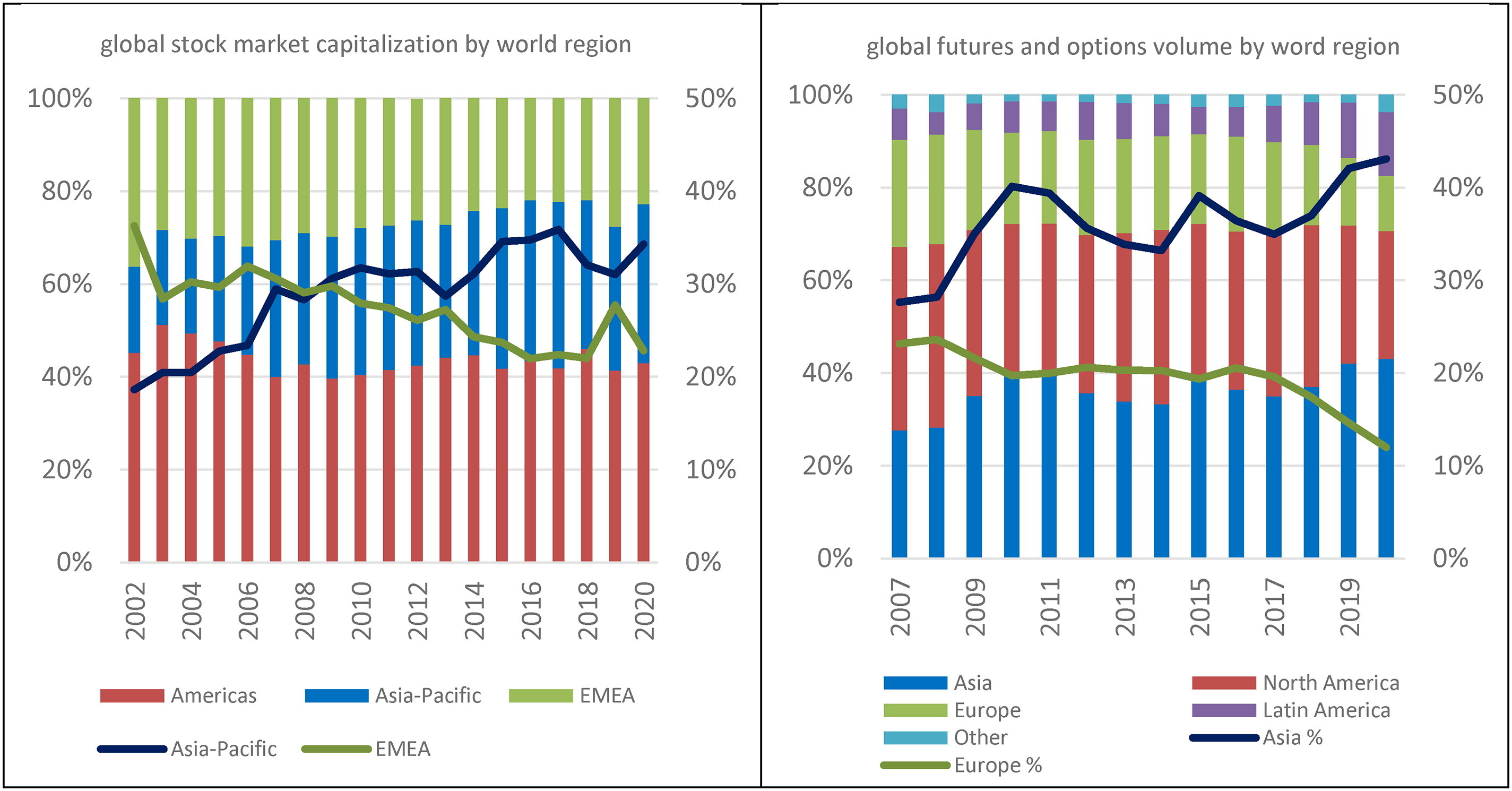

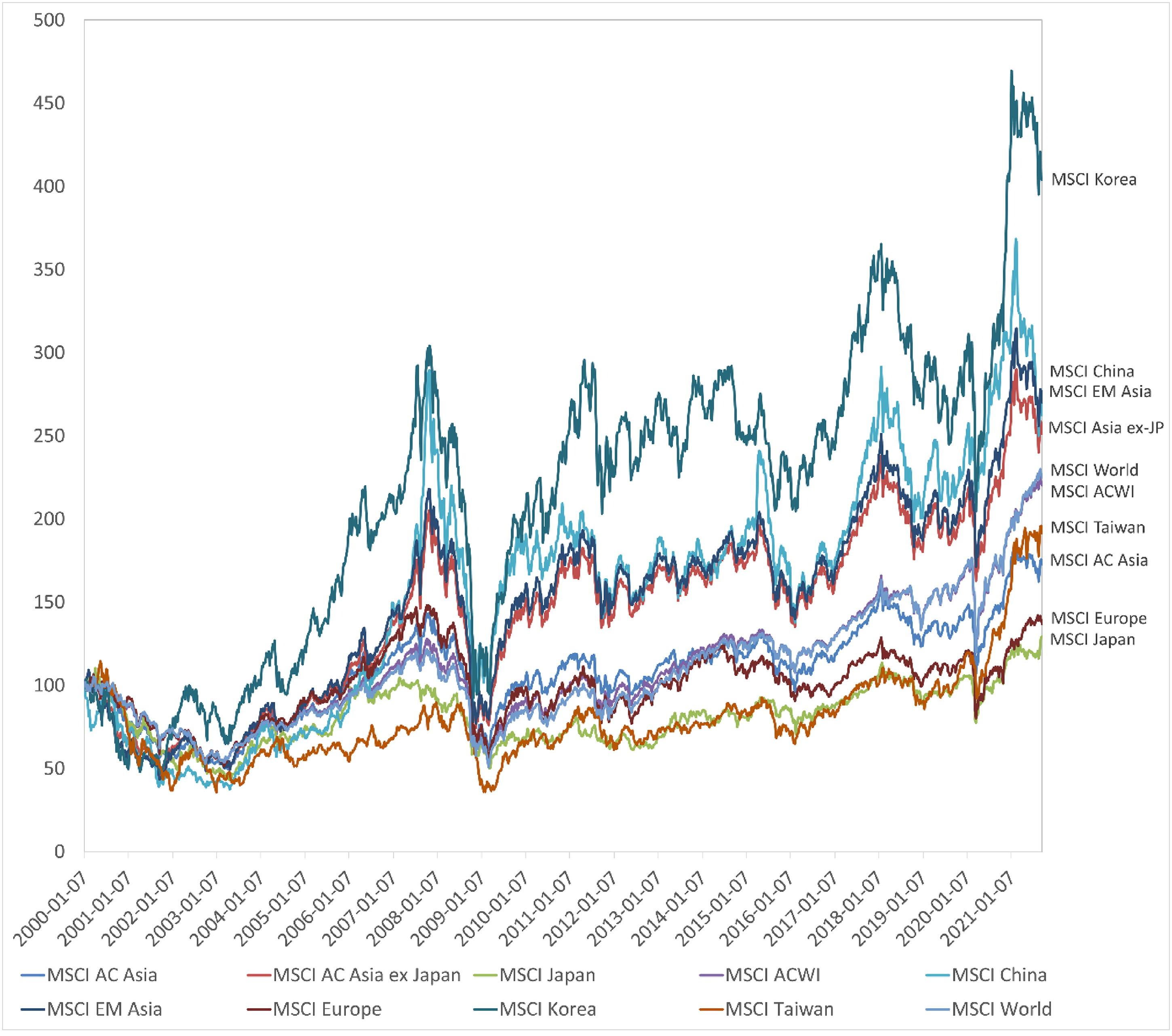

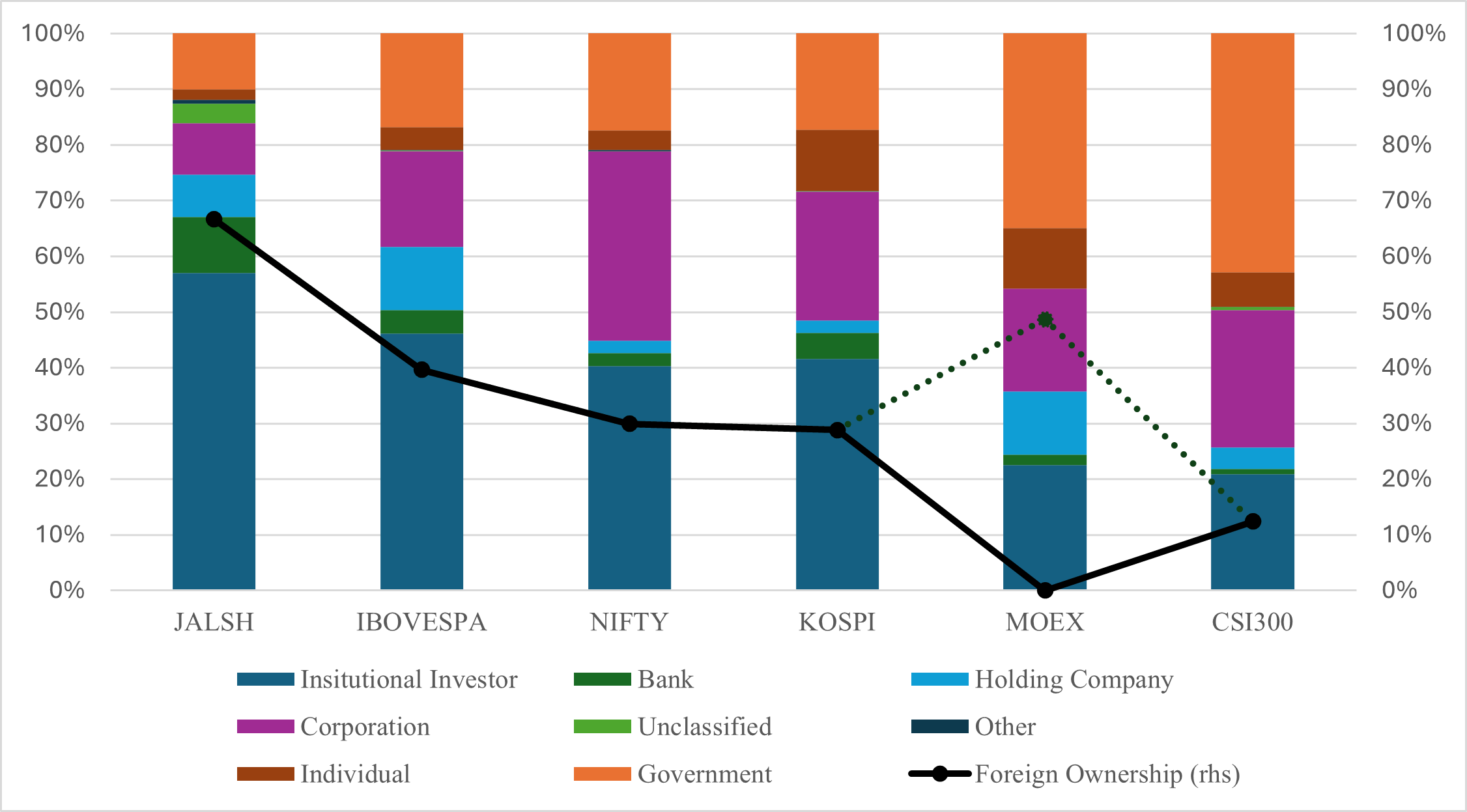

As the principle investigator of the DFG-funded StateCapFinance research project at Goethe University Frankfurt (2020-2025), I investigate similarities and differences in the relationships between states and (global) financial markets in China, the BRICS and East Asia as well as US/European markets. By comparatively analysing market structures, large financial datasets and interview data, we investigate whether financial markets are informed by varying institutional logics, consequently function differently and lead to different societal outcomes. We further investigate how these changing post-crisis reconfigurations within the global financial system such as the rise of China – by itself or within East Asia and the BRICS – then impact the norms, institutions and power constellations that underpin the global economy.

Through this project, we bring together three central concepts in political economy literature: state capitalism, neoliberalism and financialization. We argue that rather than being uniform, capital markets can function according to different logics – which we place on a continuum between neoliberalism and state capitalism – and which consequently has important consequences for the socio-economic outcomes these markets produce. Therefore, our findings have important implications for political economy debates on the transformation of state capitalisms, trajectories of financialisation, neoliberalism as a policy paradigm as well as the study of capital markets.

Funded by the German Research Foundation (DFG), Goethe University Frankfurt

investigators: Andreas Nölke and Johannes Petry (PI) (project-no.: NO 855/7-1; 2020-2025)

Global network of cooperation partners

Workshop 2022 – Emerging markets between financial subordination & statecraft (Frankfurt)

Workshop 2023 – Asia and the liberal global financial system (Frankfurt)

Workshop 2024 – Asia’s role in international financial affairs (San Francisco)

___________________

major publications

Petry, J. & A. Nölke (2024). BRICS and the global financial order: Liberalism contested? Cambridge: Cambridge University Press.

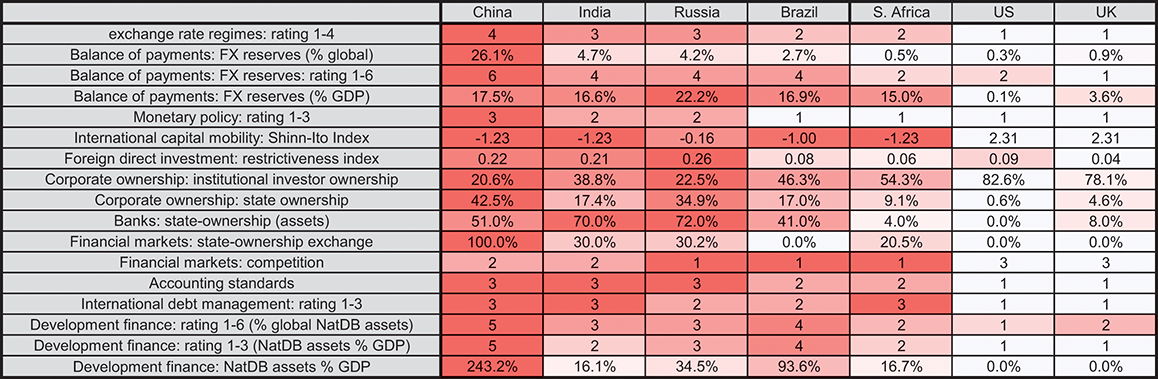

The global financial system is the economic bedrock of the contemporary liberal economic order. In contrast to other areas of the global economy, finance is less frequently analyzed in discussions on contestations of economic liberalism. However, a quite comprehensive process of external contestation of the global financial order (GFO) is under way. This contestation, we argue, takes place through the rising share of emerging market economies within global finance in recent years, especially the rise of the BRICS economies. This book investigates whether and how the BRICS contest the contemporary GFO by conducting a systematic empirical analysis across seven countries, eleven issues areas and three dimensions. This contestation takes place across issue areas but is mostly concentrated on the domestic and transnational dimension, not the international level on which much research focuses. Rather than all BRICS as a whole, it is especially China, Russia and India that contest liberal finance.

___________________

Petry, J. & A. Nölke (forthcoming). State, capitalism and finance in emerging markets: Between subordination and statecraft. Bristol: Bristol University Press.

What is the role of emerging markets within the global financial system? Are they completely subordinated within global financial hierarchies? Or do they have autonomy, even power, to use finance to pursue state objectives? Combining insights from the literatures on financial subordination, financial statecraft and comparative capitalism, this book explains commonalities and differences in state-finance relationships between emerging markets. On the one hand, we see considerable amounts of state activism in and growing entanglement with finance across emerging markets, both at the domestic level and with respect to ‘global’ financial markets. On the other hand, we also observe significant variation in state-finance relationships – ranging from financial subordination towards actively and successfully utilising finance for pursuing economic policy. This book demonstrates that the state in large emerging economies is not necessarily a helpless victim of financialization. Even under conditions of a subordinated position within the global financial system, it is able to exercise control over the domestic financial sector and even engage in powerful financial statecraft internationally. However, emerging economies differ substantially in the degree to which they can mobilize this potential state capacity. By drawing on comparative capitalism literature which analyses the role and power of the state within the institutional configurations of national capitalisms, we explain variation in the degree and reach of state capacity and how it conditions different patterns in the relationship between states and domestic as well as global finance

___________________

Pape, F., J. Petry & L. Rethel (2025) Special Section: How does the rise of Asia reshape international financial affairs? International Affairs, 101 (5).

The rules, norms and procedures that govern contemporary cross-border money and finance were put in place by western powers after the end of the Bretton Woods era. The recent rise of novel, often state-linked, Asian financial actors and practices poses questions for the continued centrality of liberal and free-market ideas in global finance. This special section asks: how do Asian financial actors integrate into the global financial system? Do they contest, co-opt or comply with liberal norms of market organization? Conversely, how do global financial actors interact with Asian financial systems? And what are the geopolitical and geo-economic implications of these developments? We offer three avenues of investigation: first, while Asian forms of financial capitalism remain distinct, their resilience in the face of liberal global norms has not hindered a dynamic transformation as local financial systems internationalize and interact with the global order. Second, the internationalization of Asian finance has introduced novel financial practices into the global system that rewrite existing practices in areas as diverse as debt, development and exchange rate management, demonstrating the growing agency of Asian countries in regional and global financial affairs. Third, in these activities Asian finance is seen from the outside at times as a friendly competitor and at other times as an outright threat, creating potential fault-lines subject to growing geopolitical contestations. Through these insights, we move beyond the existing literature that continues to see Asia, and countries within Asia, merely as respondents to financial change and globalization, rather than as increasingly powerful agents in their own right.

__________________

Pape, F., Petry, J. & Rethel, L. (2025) How does the rise of Asia reshape international financial affairs? International Affairs, 101 (5), 1553–1565.

Nölke, A. (2024) Private institutions in infrastructural geoeconomics: limits to the rise of emerging economies in global finance. Finance and Space, 1(1), 282-298.

Pape, F. & J. Petry (2023) East Asia and the politics of global finance: a developmental challenge to the neoliberal consensus? Review of International Political Economy, 31(1), 224–252.

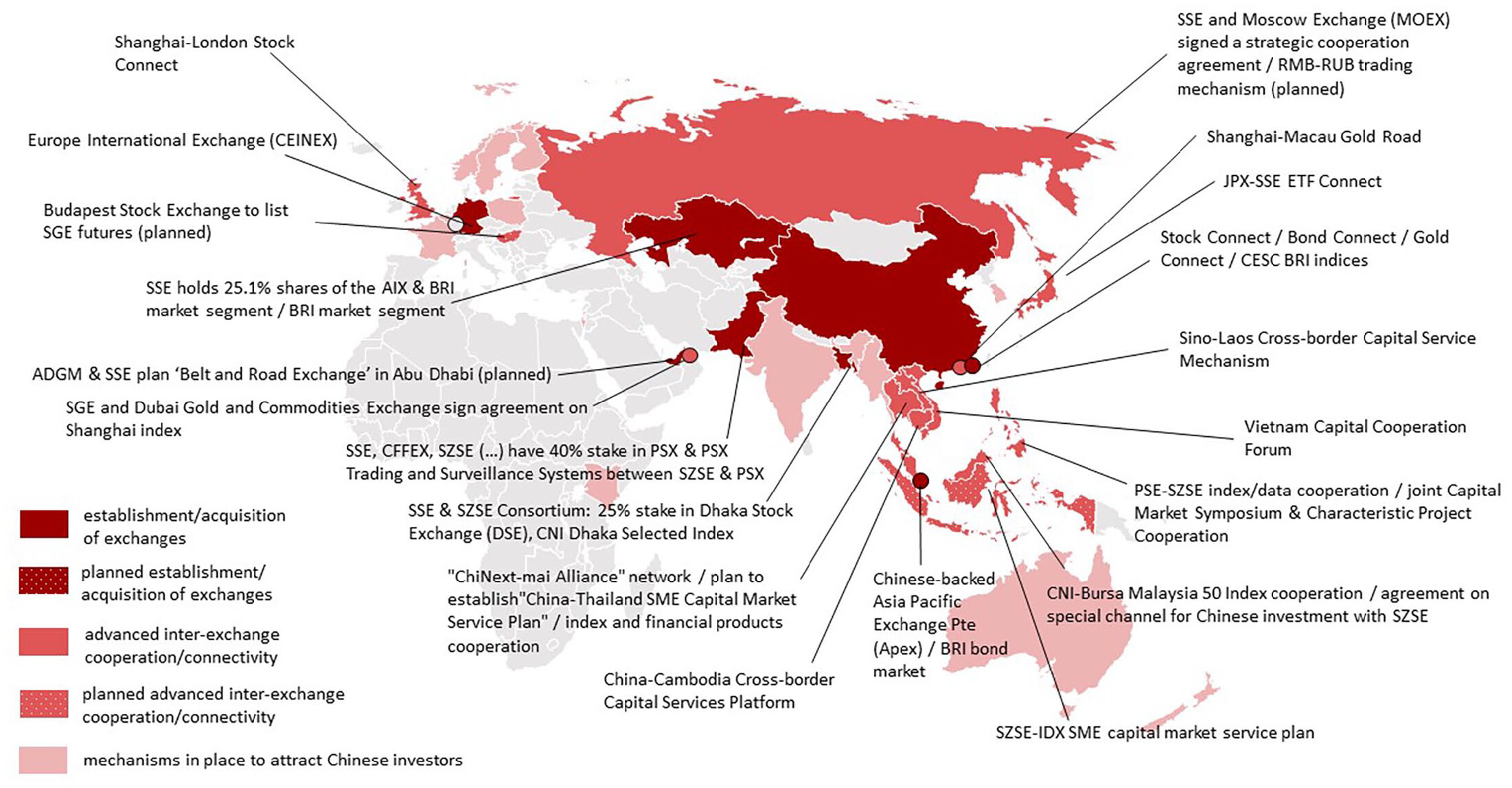

Petry, J., K. Koddenbrock & A. Nölke (2023) ‘State capitalism and capital markets: Comparing securities exchanges in emerging markets’ Environment and Planning A: Economy & Space, 55(1): 143-164.

Petry, J. (2021) ‘Same same, but different: Varieties of capital markets, Chinese state capitalism & the global financial order’, Competition & Change, 25(5): 605-630.

___________________

data insights