Since the global financial crisis, we can observe the emergence of passive investment through asset managers as a central feature of how capital is allocated. In this project, my colleagues and I therefore explore different dimensions of this shift towards passive investment, notably the role of index providers, their relationship to asset managers, global geographies of asset management capitalism as well as the shift towards ESG investing.

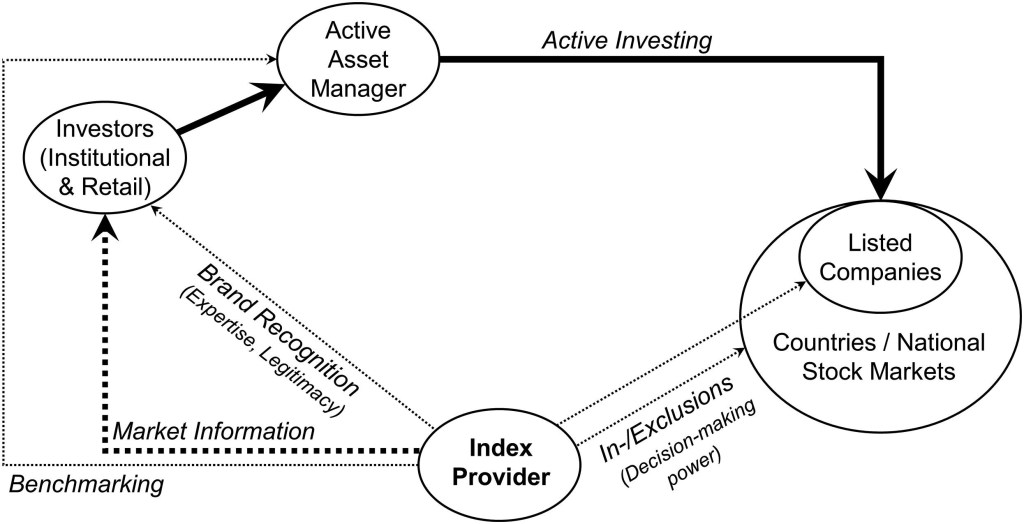

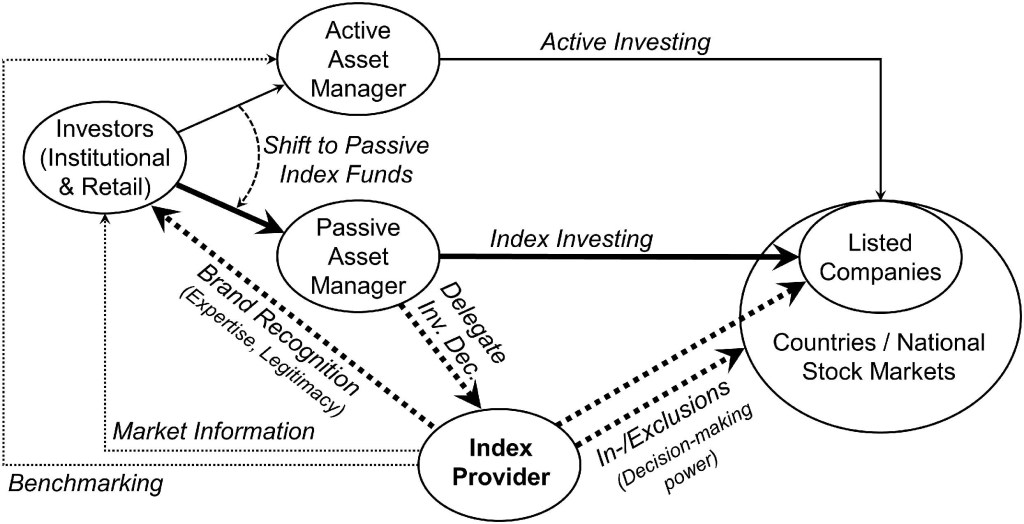

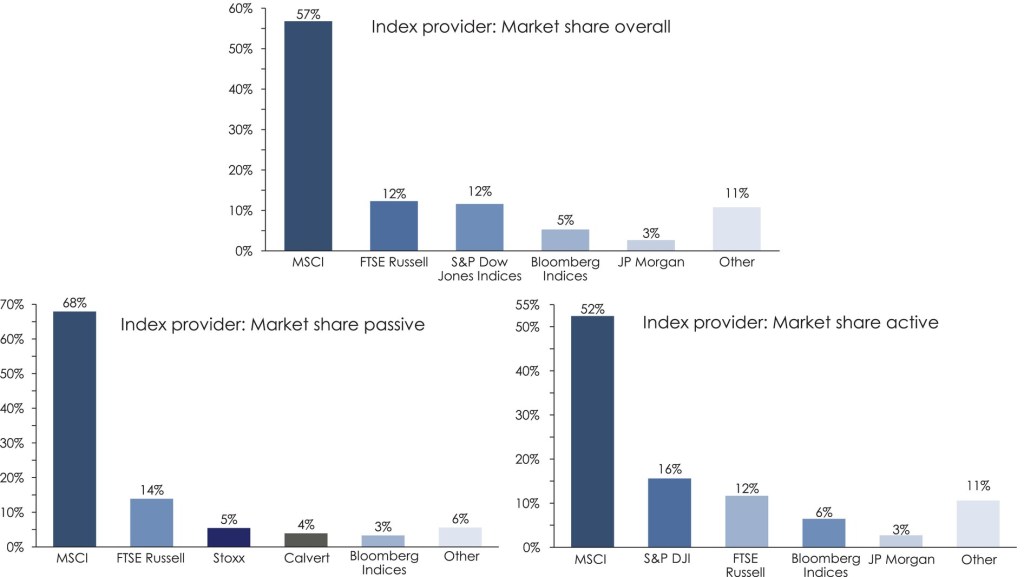

Rather than picking stocks, passive funds replicate stock indices such as the S&P 500. But where do these indices actually come from? This research project analyses the politico-economic role of index providers. We argue that these index providers have become actors that exercise growing private authority as they steer investments through the indices they create and maintain. While technical expertise is a precondition, their brand is the primary source of index provider authority, which is entrenched through network externalities. Rather than a purely technical exercise, constructing indices is inherently political. Which companies or countries are included into an index or excluded (i.e. receive investment in- or outflows) is based on criteria defined by index providers, thereby setting standards for corporate governance and investor access. Hence, in this new age of passive asset management index providers are becoming gatekeepers that exert de facto regulatory power and thus may have important effects on corporate governance and the economic policies of countries.

Moreover, in this new economic reality index providers have become crucial intermediaries in the relationship between states and investors. Through producing widely used indexes, index providers essentially provide a crucial infrastructure that enables the creation and trading of increasingly passively allocated financial claims. Through the infrastructural power they derive from this gatekeeper position, index providers are able to ‘standardise’ the issuers of capital claims and the countries in which these issuers reside through determining the criteria that corporations and states, especially emerging markets, have to fulfill to qualify for index membership – and consequently asset allocation. Index providers thereby exert great influence on domestic financial regulation, investor access and international capital flows.

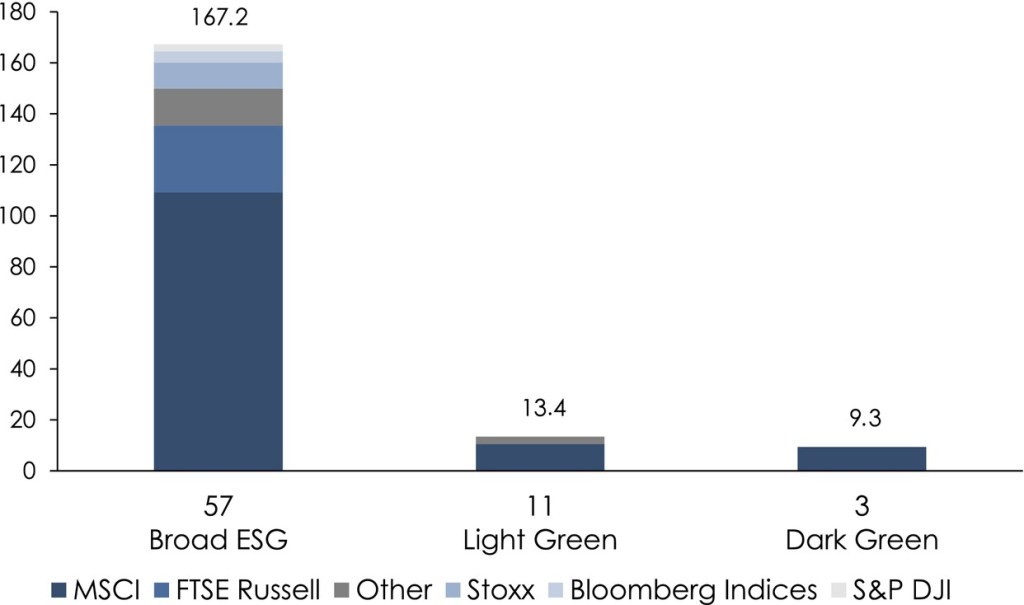

Finally, environmental, social, and governance (ESG) funds are among the fastest-growing investment styles in an age of passive asset management. ESG investing thereby has a governing effect, and a key open question is whether ESG merely reduces risks for investors or whether it can have a sustainability impact and actively contribute to climate transition. This governance through ESG is characterized by three potential transmission mechanisms: ratings, shareholder engagement, and capital allocation. These can create sustainability impact or constitute “ESG gaps” if transmission mechanisms remain ineffective/unutilized. Based on financial data, an investigation of ESG methodologies and expert interviews, we provide a novel ESG market analysis, focusing on the standard-setting role of a handful of ESG index providers in capital allocation. Our findings highlight that while “Dark Green” indices could have an impact, currently “Broad ESG” indices, which do not meaningfully facilitate sustainability, dominate investing: we call this the “ESG capital allocation gap.” This has important implications, because effective transmission mechanisms are crucial for ESG funds to achieve sustainability impact in the real economy.

___________________

major publications

Fichtner, J. & Petry, J. (forthcoming) Global finance. In: G.K. Wilson & M. Maguir (eds) Elgar Encyclopedia of Business and Government. Cheltenham: Edward Elgard (pre-print).

Fichtner, J., R. Jaspert & J. Petry (2025) ESG: the socio-technical infrastructure of ‘sustainable’ investing. In: C. Westermeier, M. Campbell-Verduyn & B. Brandl (eds) The Cambridge Global Handbook of Financial Infrastructure. Cambridge: Cambridge University Press, 274-284

Fichtner, J., R. Jaspert & J. Petry (2024) Mind the ESG capital allocation gap: The role of index providers, standard-setting, and “green” indices for the creation of sustainability impact. Regulation & Governance, 18(2): 479-498.

Fichtner, J, E. Heemskerk & J. Petry (2022) ‘The new gatekeepers of financial claims: States, passive markets, and the growing power of index providers’, B. Braun & K. Koddenbrock (eds.) Capital claims: Following finance across borders (RIPE Series). London: Routledge (pre-print).

Petry, J., J. Fichtner & E. Heemskerk (2021) ‘Steering capital: The growing private authority of index providers in the age of passive asset management’, Review of International Political Economy, 28(1): 152-176.

___________________

data insights

____________

____________

____________