Are banks still the masters of the universe? This project will investigate post-crisis transformations in the global financial system with a focus on changing actor constellations and a subsequent relocation of power within global finance.

Banks were hit by the brunt of financial regulation after the 2007-2009 global financial crisis and they had to significantly scale down many of their activities. But financial activity did not subsequently disappear. Instead, we can observe the emergence of new powerful actors in financial markets – from high frequency traders and hedge funds, to asset managers and private equity funds, as well as exchanges, proxy advisors and index providers.

While existing studies have focused on individual parts of this development, there has to date been no study that explores the systemic implications this has for the politics of global finance, specifically for where power is located within global markets. The project thus explores the lineage of financial activity and spillovers of financial innovation between different groups of financial actor that are likely not yet subject to sufficient regulatory scrutiny.

[work in progress]

___________________

key publications (exchanges only)

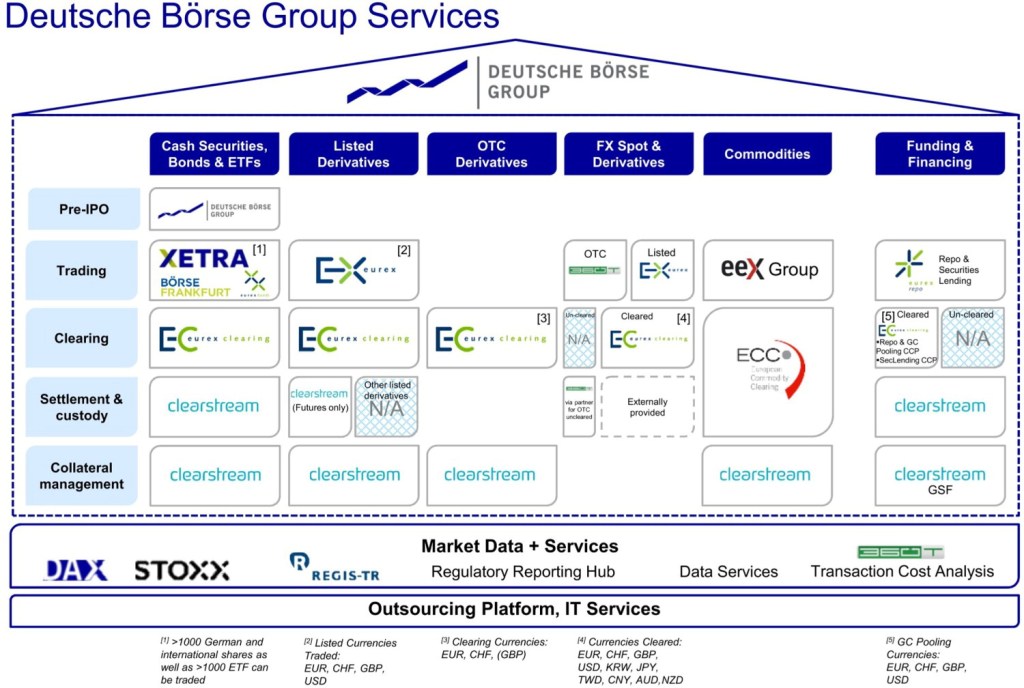

Petry, J. (2025) Exchanges: infrastructure, power & the differential organisation of capital markets. In: In: C. Westermeier, M. Campbell-Verduyn & B. Brandl (eds) The Cambridge Global Handbook of Financial Infrastructure. Cambridge: Cambridge University Press, 167-178 (open access).

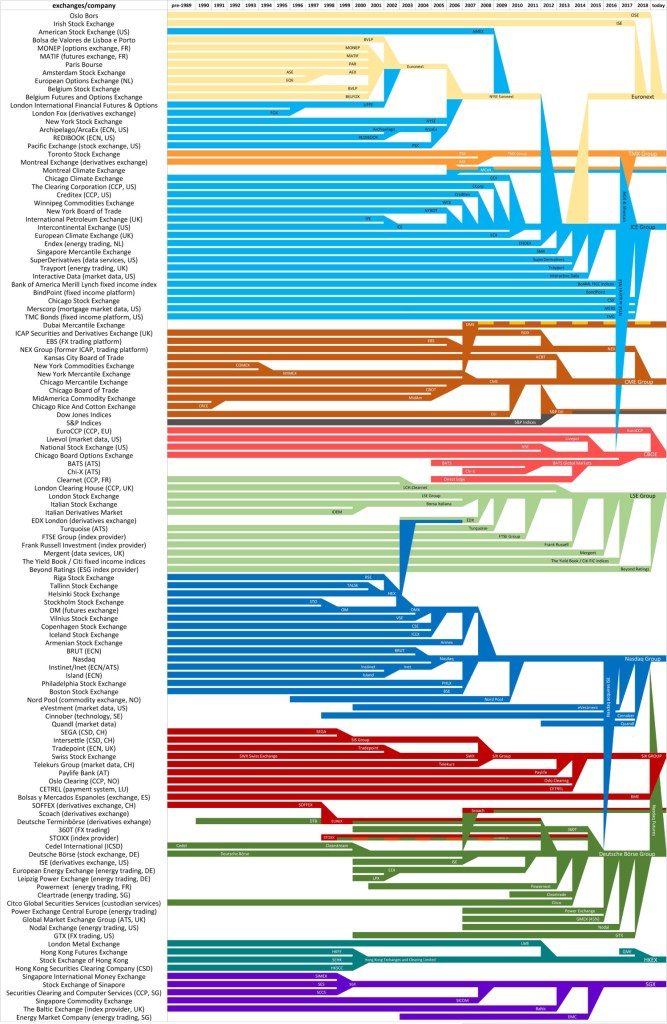

Petry, J. (2021) ‘From national marketplaces to global providers of financial infrastructures: Exchanges, infrastructure and power in global finance’, New Political Economy, 26(4): 574-597

Petry, J. (2020) ‘Securities exchanges: Subjects & agents of financialization’, P. Mader, D. Mertens & N. van der Zwan (eds) The Routledge International Handbook of Financialization. London: Routledge, 253-264 (pre-print).

___________________

data insights (exchanges)

__________

_________